Taking care of your family is your primary goal, so you’ve decided to learn more about life insurance to help protect their financial future. But it doesn’t take long to get lost in the lingo: short-term vs. long-term life insurance, permanent, universal, variable and more.

“Short-term” generally refers to term insurance, which provides affordable coverage for a specific period, like 10 to 30 years. There’s also temporary life insurance, which covers a year or less. Meanwhile, “long-term” usually means permanent life insurance, which can cover you for the rest of your life.

Understanding the different types of life insurance

All life insurance essentially works the same way: You purchase it by making payments (a “premium”) to a company, and if you pass away while you’re covered, the company will pay out the defined amount to the people you’ve named as beneficiaries.

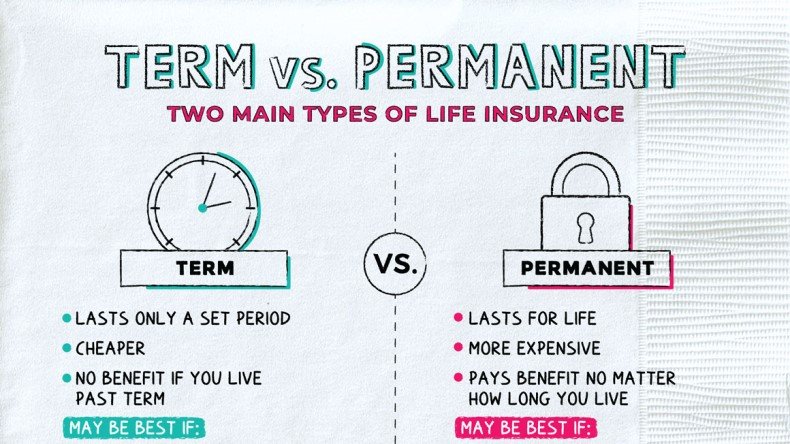

One of the primary factors in choosing life insurance is deciding how long you want the coverage to last. Here’s what you need to know about your short-term vs. long-term life insurance options.

Term life insurance covers you for a set period

Another form of coverage is term insurance. It covers you for a specified time, with options like 10-, 15-, 20- and 30-year terms. You can determine which contract length and value best meets your needs. As long as your premiums are paid, your loved ones will receive your death benefit if you pass within the contract period.

Key things to know about term life insurance:

- Provides coverage for both short and long lengths of time

- Has fixed premiums with varying costs

- May be renewable at the end of the term, but premiums may rise

- Offers no cash value option

Term insurance is generally less expensive than permanent coverage because it doesn’t accrue a cash value—money you can access during your lifetime—and it can expire without paying out a benefit. Many people get a term policy in early to mid-adulthood to provide for their family or cover the cost of a mortgage if they were to pass away.

Permanent life insurance covers you for life

Permanent life insurance is an umbrella term for a variety of long-term coverage, including whole life, universal life and variable universal life. It’s designed to protect you and your loved ones throughout your lifetime, as long as coverage remains in force. In addition to a death benefit, permanent life insurance often has a cash value component, which means you can withdraw money from your accumulated funds.

Key things to know about permanent life insurance:

- Can provide lifetime coverage

- May have fixed or flexible premiums

- Doesn’t need to be renewed, so premiums won’t increase

- May offer a cash value option with interest or investment-earnings growth

Permanent coverage can be more expensive than term, but it may fit your needs if you don’t want to worry about your age, health or risk factors affecting your premium prices over the long term. You also have access to your cash value for any use while you’re alive—whether to supplement your retirement needs or to cover a major purchase—making it a versatile financial planning tool.

Factors to consider when exploring life insurance

Selecting life insurance coverage is a personalized decision, and it may even change over time as your lifestyle and needs shift. When determining how much coverage you should have, you may want to consider:

- Your family and loved ones—who do you provide for and what are their needs?

- Your income—what would it take to replace what you earn?

- Your financial obligations—do you have debts your survivors would struggle to pay?

- Your age and health—how would these affect your premium rates?

- Your risk factors—do you have a lifestyle or hobbies that endanger your safety?

- Your legacy—do you want insurance to be a means of passing generational wealth?